John Cochrane responds to my piece on why there is no evidence that the economy is self-correcting with an excellent blog post

on unit roots. John's post raises two issues. The first is descriptive statistics. What is a parsimonious way to describe the time series properties of the unemployment rate? Here we agree. Unemployment is the sum of a persistent component and a transitory component.

The second is economics. How should we interpret the permanent component?

I claim that the permanent component is caused by shifts from one equilibrium to another and that each of these equilibria is associated with a different permanent unemployment rate. I’ll call that the “demand side theory”. (More on the data here and here and my perspective on the theory here and here ).

Modern macroeconomics interprets the permanent component as shifts in the natural rate of unemployment. I’ll call that the “supply side theory”. That theory is widely accepted and, in my view, wrong. As I predicted in the Financial Times back in 2009, "the next [great economic idea] to fall will be the natural rate hypothesis".

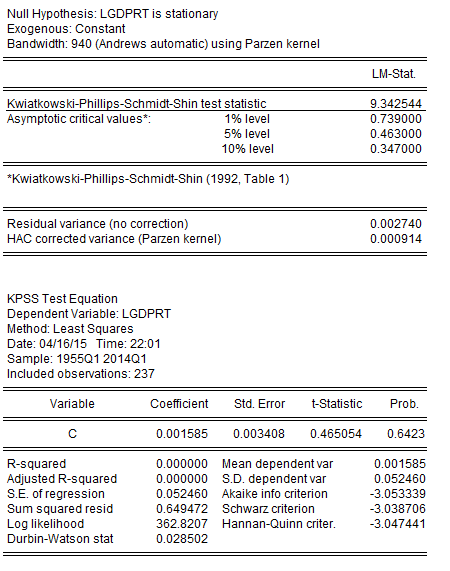

Lets start with the statistics.

In the comments section, (always worth reading beyond the main post) John and I are in complete agreement that unemployment has two components. One is highly persistent, and well approximated by a random walk. The other is stationary.

Here is John

Hi Roger. We’re converging. Yes, there is an interesting low frequency component in unemployment, that might be modeled well in a short sample with a random walk (unit root = random walk plus stationary component). And unit root asymptotics might be a better approximation to finite sample distributions, plus warn of biases like the AR(1) coefficient.

A random walk, as its name suggests, has an equal chance of going up or down. A stationary variable always returns to a constant number. What about a series that is the sum of a random walk and a stationary component? The stationary bit is always pulling the unemployment rate back to something: but that something is not a number, it’s the random walk component. Unemployment is aiming at a moving target.

John has his own unit root tests. In John's words

"Look at the plot" and "think about the units"

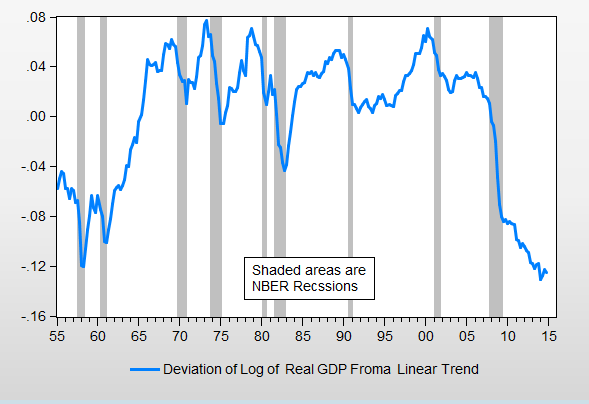

I like that. Here is my “look at the plot” diagram seen through the lens of John’s comment that a unit root equals a “random walk plus stationary component”