Start with three equations.

1. The production function: Y=F(L). Output (Y) is a function of employment (L).

2. A "classical" labour demand curve: W/P=MPL(L). The real wage (W/P) equals the Marginal Product of Labour, which is a decreasing function of employment. This is Keynes' "first classical postulate", which he agreed with.

3. A "classical" labour supply curve: W/P=MRS(L,Y). The real wage equals the Marginal Rate of Substitution between labour (or leisure) and output (or consumption). This is Keynes' "second classical postulate", which he disagreed with (except at "full employment").

From 1 and 2, plus some tedious math, we can derive what Keynes calls "the aggregate supply function": PY/W = S(L). It shows the value of output, measured in wage units, as a function of employment. It is substantively identical to the Short Run Aggregate Supply Curve in intermediate macro textbooks that assume sticky nominal wages: Y=H(P/W), which uses the exact same equations 1 and 2, but presents the same solution differently.

From 1 and 3, plus some tedious math, we can derive a second "aggregate supply function", that is not in the General Theory: PY/W = Z(L). It is substantively identical to the short run aggregate supply curve implicit in New Keynesian models, which assume sticky P and perfectly flexible W, so the economy is always on the labour supply curve and always on the production function.

From 1 and 2 and 3, plus some tedious math, we can solve for Y, L, and W/P, and derive a third aggregate supply function: Y=Y*. This is the textbook Long Run Aggregate Supply curve. It is identical to the solution we could get if we solved for the levels of Y, L, and W/P that satisfied both the first and second "aggregate supply functions".

In Chapter 4 of The General Theory, Keynes suggests that we measure output in wage units. Here is Nick again on that point...

Keynes' weird habit of measuring output in wage units had an unfortunate result: because [it implies that] doubling the real wage, for a given level of output and real income, would exactly double output demanded.That is simply false. There is no unique concept of output in a multi-good economy. Contrary to Nick's assertion, there is nothing 'weird' at all about the measurement of GDP in wage units. It is a clever device that allows us to measure real GDP and to concentrate on the determinants of aggregate economic activity.

And Nick claims later in his post that

There is absolutely nothing new on the supply-side in chapter 3 of the General Theory.Not so. Although there is no 'theory' of aggregate supply that would satisfy a micro economist, that is not the same as Nick's claim that there is nothing new. What is new is the assertion that Keynes will drop the classical second postulate. In other words: throw away the labor supply curve. Making sense of that statement is what my own work is all about.

Back to Nick...

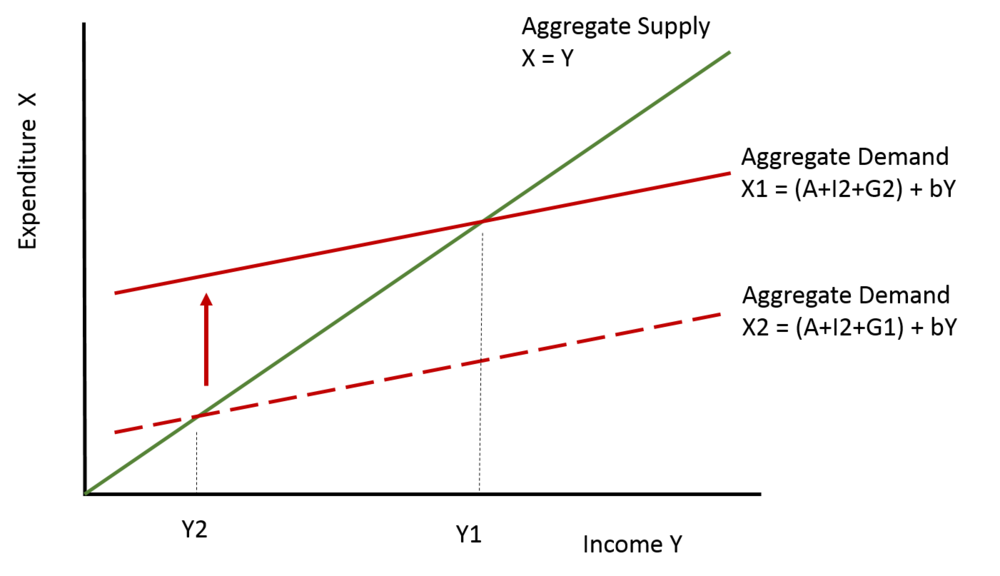

It is the demand-side that is new. It is the idea that the demand for goods is a function of the quantity of labour that households are actually ableto sell. If households are rationed in the labour market, that will spillover and affect their demand in the output market. Because the amount of labour they are actually able to sell, and hence the income they will earn from wages plus non-wages, depends on demand. Which means that demand depends upon demand. Demand depends on itself. That was new, and interesting."

Attempts to reconcile short run cross section evidence and long run time series evidence on the value of the multiplier led to permanent income theory and the Ricardian equivalence debate. That debate is what we are all so heated up over right now. If the GT is nothing but the Keynesian multiplier, and if that theory is wrong, then what is the Wannabe Keynesian left with?